Building a Corpus of Rs 18 Crore by Investing Rs 15,000/Month in Equity Mutual Funds through SIP

Introduction:

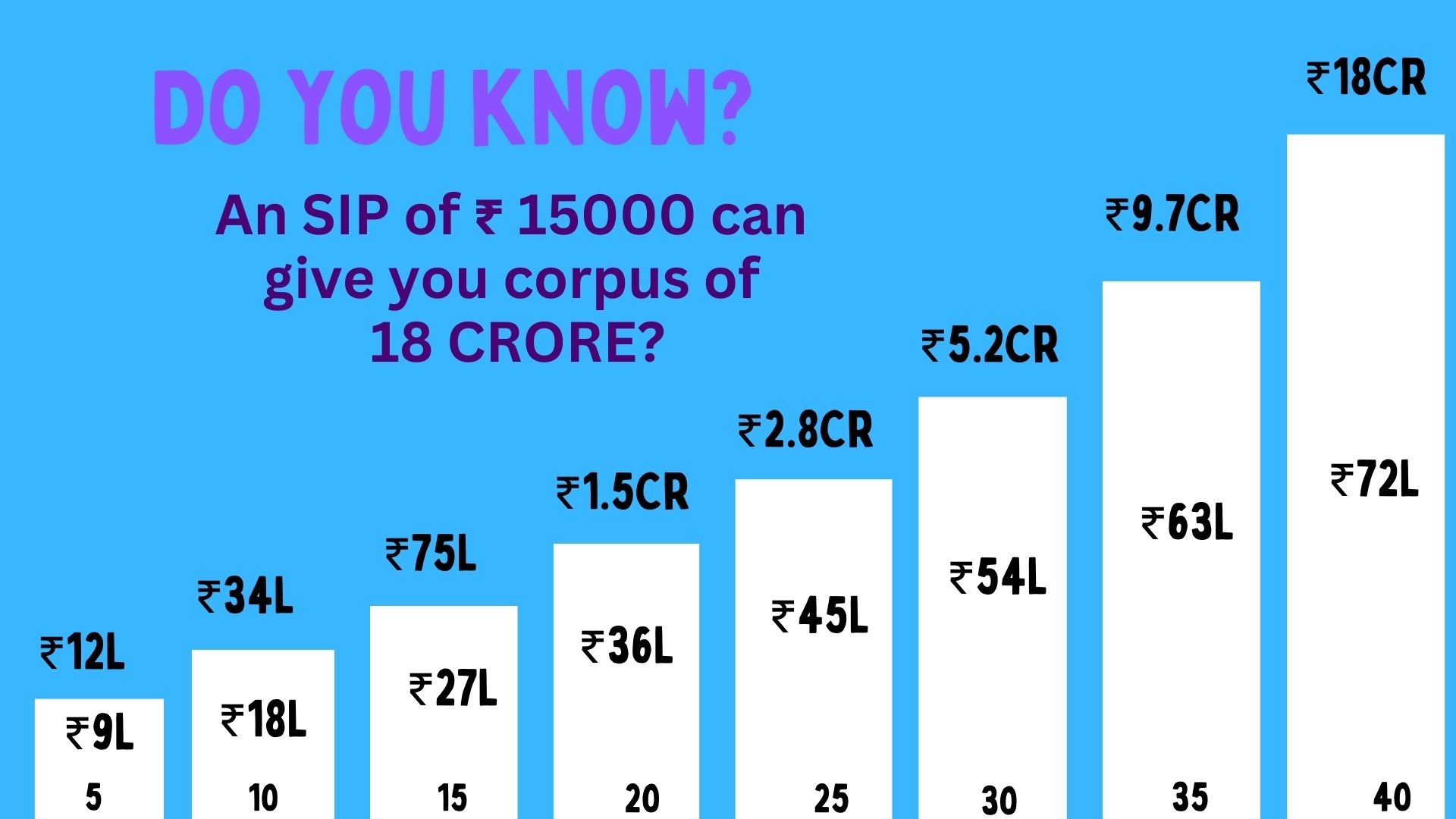

Building a corpus of Rs 18 crore through a Systematic Investment Plan (SIP) is a strategic approach to long-term wealth creation. By consistently investing Rs 15,000 each month into equity mutual funds over 40 years, you can harness the power of compounding to achieve this ambitious financial goal. In this article, we’ll explore how a SIP works, the benefits of investing regularly, and how you can use our SIP calculator to project and plan your journey towards building a corpus of Rs 18 crore.

Understanding the Power of Compounding

Compounding is a potent financial principle where the returns on your investments generate their own returns over time. When you invest regularly through SIPs, your returns are reinvested, leading to exponential growth. This makes SIPs a powerful tool for long-term wealth creation. Use the best SIP Calculator

Key Assumptions

To achieve a corpus of Rs 18 crore, we make the following assumptions:-

1. Monthly Investment: Rs 15,000

2. Investment Period: 40 years

3. Annual Return Rate: 12%

While a 12% annual return may seem optimistic, it is attainable given the historical performance of equity mutual funds in India.

Calculating the Future Value of SIP Investments

The future value of your SIP investments can be calculated using the formula:-

Future Value=P×((1+r)n−1r)×(1+r)\text{Future Value} = P \times \left( \frac{(1 + r)^n – 1}{r} \right) \times (1 + r)Future Value=P×(r(1+r)n−1)×(1+r)

Where:-

1. PPP is the monthly investment amount (Rs 15,000)

2. RRR is the monthly interest rate (12% annual return / 12 months = 1% or 0.01)

3. NNN is the total number of investments (40 years \times 12 months = 480)

Plugging these values into the formula:-

Future Value=

15000×((1+0.01)480−10.01)×(1+0.01)\text{Future Value} = 15000 \times \left( \frac{(1 + 0.01)^{480} – 1}{0.01} \right) \times (1 + 0.01)Future Value=15000×(0.01(1+0.01)480−1)×(1+0.01)

This calculation shows that the future value of your investments would be approximately Rs 18 crore.

Advantages of SIPs

1.Rupee Cost Averaging: SIPs enable you to buy more units when the market is down and fewer units when the market is up, averaging out the cost of your investments over time.

2.Discipline and Convenience: SIPs instill discipline as they require regular investments, which can be automated and are convenient.

3.Flexibility: You can start SIPs with as little as Rs 500 per month and increase the amount as your income grows.

Selecting the Right Mutual Funds

Choosing the right equity mutual funds is crucial for achieving your financial goals. Here are some factors to consider:

1.Fund Performance: Look for funds with a consistent track record of performance over different market cycles.

2.Fund Manager: Experienced and reputable fund managers can significantly impact the fund’s performance.

3.Expense Ratio: Lower expense ratios mean more of your money is being invested rather than being used to cover management fees.

Risks and Considerations

While equity mutual funds have the potential to generate high returns, they also come with risks. Market volatility can lead to fluctuations in the value of your investments. It is essential to have a long-term perspective and not be swayed by short-term market movements.

Steps to Get Started

1.Set Clear Goals: Define your financial goals and the time horizon for achieving them.

2.Choose the Right SIP: Research and select mutual funds that align with your risk tolerance and investment objectives.

3.Monitor and Adjust: Regularly review your portfolio and make adjustments as needed to stay on track.

Conclusion:-

Investing Rs 15,000 per month in equity mutual funds through SIPs can help you build a substantial corpus of Rs 18 crore over 40 years, thanks to the power of compounding. By selecting the right funds and maintaining a disciplined approach, you can achieve your financial goals and secure a prosperous future.

For more detailed calculations and personalized advice, use the tools available on ETCalculator to plan your investments effectively. Start your investment journey today and let compounding work its magic to build a secure and wealthy future.

For more personalized investment strategies and detailed calculations, use the SIP Calculator tools available on ETCalculator.com. Start your SIP journey today and let compounding work its magic to build a secure financial future.

To explore more financial calculators, simply ( Click Here )